Roundup #54 🥱🌈

Opening a business, consolidating debt, intimidated to file taxes, and investing beyond 401(k)'s.

Welcome to The Boring Gay newsletter where I cover topics including the gay experience, career, money, and cars. In this edition, I answer money questions from my IG community.

Question 1

What’s your financial advice for someone who wants to open a storefront in the future?

Lex: I love entrepreneurs! Opening your own storefront can be a really rewarding way to earn money and be your own boss. I advise you to ask as many people as possible who have opened similar stores for their advice. Perhaps not your potential competitors, but go to a different city and look up a few stores that do what you might want to do and see if you can get in touch with the owner. If you come at them respectfully (and let them know you are in no way going to be their competitor), they may want to help you out. Ask them how much money it took to get started - how many months it took for them to make a steady income, etc. I would also suggest you do financial projections for your worst-case scenario. When starting a business we tend to be optimistic and might assume we’re going to make X in a month - but are you prepared to survive if you make half of that number? 10% of that number? It’s easy to adjust when things go better than expected - it’s almost impossible to adjust when you don’t plan for turbulence, especially in the first few months when people don’t know your business. I don’t know what you plan to sell, but you also want a strong focus on social media, as many small businesses can thrive with strong support from their local community which you can find online. Find social media accounts that focus on the local community and start liking, commenting, and following their most active followers (in a thoughtful, non-trolling way). Try to reach out to people on Yelp who seem to leave thoughtful reviews for other local businesses and ask if they’ll stop by yours. Just a few ideas…

Question 2

The monthly payments on card debt I acquired from COVID pay cuts are killing me - how can I consolidate?

Lex: I’m sorry COVID put you in a bad financial position - this is unfortunately common right now. While debt consolidation might be beneficial, you want to be sure that the interest rate on any debt consolidation loan is lower than the interest rates on your credit cards. That might be challenging to get if your credit score is bad due to high card balances - companies tend to take even more advantage of you when they know you’re desperate for the money. You also want to be sure debt consolidation isn’t just extending your debt for years to get you a cheaper payment today - that might choke you financially for longer than you can handle. You might look into credit cards that have low-interest balance transfer offers, which might be an easier way to move at least some (if not all) of your debt to a new card with low interest so you can pay it down faster. Those balance transfer offers always have time limits though, so it’s best if you create a plan to pay down as much as you can within the time period because the interest rate goes up afterward. I think my biggest suggestion to you would be to find a side hustle to bring in a little more income to pay down debt faster. There is never a penalty for paying more than your minimum on a credit card, and doing so effectively reduces your interest rate similar to what debt consolidation or balance transfers accomplish.

Question 3

How can I make income taxes less terrifying for myself - I hate tax season.

Lex: Taxes can be very intimidating, but I think with the online programs that exist to file your own taxes (TurboTax, TaxAct, etc.), they can be much easier than you think. Those sites walk you through exactly what you need to do step-by-step and offer targeted help articles and even access to video chat professionals (if you pay extra) for more tricky questions. I’ve been filing my own taxes for at least a decade alone, and I definitely am not an expert. By doing it myself I’ve learned a lot (through those services and Googling advice for certain situations) and I feel empowered knowing what’s going on. That trickles down into my day-to-day financial decisions because I know way ahead of tax season how certain decisions may be helpful for write-offs, etc. Unless you’re running a very complicated business or have a rare tax situation, I recommend doing your taxes yourself. If you ever feel unsure, you can always pay a professional to do it one year - see what they did on the documents - then feel empowered to do it yourself using that filing as a guide for future years.

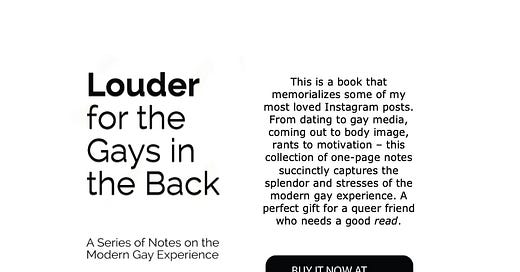

Louder for the Gays in the Back

Want to plug your business, project, cause, etc. on The Boring Gay Roundup? Let’s talk!

Question 4

I currently max out my 401(k) - what’s the best place to park extra cash long term?

Lex: Wow - congrats on this! What to do next would depend on your personal goals and risk tolerance. If you want to go deeper into retirement investing, you can also open an IRA. For me, I like the idea of being able to access my money before retirement age without penalty, so I put a significant amount in regular taxable investments, such as robo-advisors that track the stock market (Betterment, Acorns, etc.) and real estate crowdfunding (Fundrise). You may also want to invest in physical real estate and become a landlord, which can result in significant returns (plus appreciation) but might require more of your own effort to deal with tenants, maintenance, etc. There are companies that help you buy and manage real estate entirely online if you want to be hands-off (like Roofstock). There are also new services that help average investors put money into startup companies (traditionally reserved for high net-worth investors). This is a little riskier because it’s unclear when you’ll get your money back, but you may also get in early on the next Google (probably not lol). There are all sorts of things you can do, but if you’re overwhelmed, just put your money in a high-interest savings account or look into bonds and other lower-risk investments.

Lex’s Plugs

In the market for a car? Check out my recent reviews:

Investing:

With markets down, I am leaning on my Betterment Cash Reserve account. This is a high-yield savings account that you can withdraw from at any time without penalty. Betterment is offering 3.75% interest on Cash Reserve accounts. I am also continuing to invest a fixed amount into the stock market every month via Betterment investing. Although I don’t expect near-term returns, buying into the market when it’s down helps boost long-term gains. You can email me for a Betterment referral code for investing fee credits.

I am also continuing to invest into my Fundrise real estate account. While I don’t expect near-term returns, my lifetime return on Fundrise has been 9.7% since I began investing in 2021. Fundrise is designed to be a long-term investment option. I have referral codes that will reward you $50 just for creating an account. Email me for the referral link. Note: I am not a financial advisor - these are my opinions. Do your own research as all investments involve risk.

Comment of the Week

In response to my post on not minimizing your personality to appease others:

Liked something I said this week? Send me a heart or comment…I see them all!